To Invest in bonds is a great way to diversify. Bonds are debt securities where you can lend money to the bond issuer in exchange for interest payments and the return of the bond’s face value when it matures.

There are different types of bonds like government, corporate, municipal and treasury bonds. Each type has different risk and return potential so suitable for different investment objectives and risk tolerance.

Bonds allow you to lend money to an entity like a government or corporation in exchange for the bond issuer paying interest to the bondholder. When the bond matures you get back the face value of the bond provided the issuer doesn’t default.

How Bonds Work

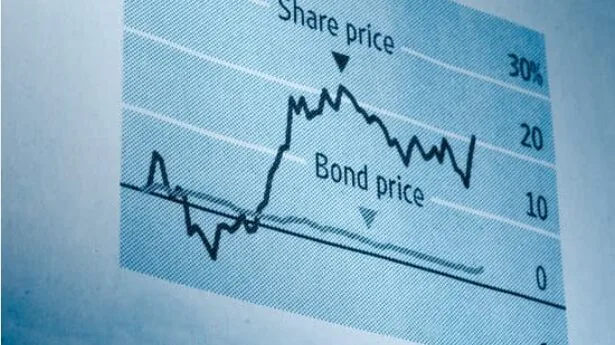

Interest rates matter in bonds. When interest rates go up, prices of existing bonds in the market go down, when interest rates go down, prices of bonds go up. This is key to investing in bonds.

Interest Rates in Bonds

Interest rates matters a lot in bonds. When interest rates go up, prices of existing bonds in the market go down, when interest rates go down, prices of bonds go up and vice versa.

Buying Bonds

Bond prices move for many reasons including interest rates, credit of the bond issuer and market demand. Knowing how bond prices work can help you make better buying and selling decisions so you get a fair price.

Bond Prices

When bond prices go down, yield goes up, so they’re more attractive to investors looking for higher returns. When bond prices go up, yield goes down, so returns go down. This inverse relationship between bond prices and yields is key to understanding when to buy or sell bonds. Timing these trades right can make big money in the bond market.

Government Bonds

Investing in government bonds can be a safe way to diversify your portfolio. Government bonds are debt securities issued by a government to raise cash.

Investors who buy government bonds are essentially lending money to the government in return for interest payments and the bond’s face value at maturity.

Pros and Cons of Government Bonds

Government bonds are considered low risk as they’re backed by the government’s ability to raise cash. They offer a fixed return and are less volatile than stocks. But government bonds generally give lower returns than riskier investments and are interest rate risk.

Municipal Bonds

Municipal bonds are issued by local governments to raise funds for public projects, such as infrastructure development or public services.Certain factors to consider when dealing with municipal bonds include the ability of the municipal to repay the bond and the tax aspect of the bond.

Benefits to invest in Municipal Bonds

Municipal bonds are tax free, the interest income is exempt from federal taxes and sometimes state and local taxes. Municipal bonds are steady income and considered safe investments.Municipal Bonds should must be considered to invest in Bonds.

Savings Bonds

Savings bonds are issued by the government so you can lend money to the government. Benefits of savings bonds are low minimum investment, fixed interest rates and backed by the government.

Benefits of Savings Bonds

Savings bonds have lower market risk than other bonds and can help you save for specific goals like education or retirement. Buy savings bonds through the U.S. Department of the Treasury or financial institutions.

Bond Funds

Bond funds can give you a diversified portfolio of bonds managed by professionals. Bond funds have diversification, professional management and access to different types of bonds without buying individual bonds. You get regular interest payments and higher returns than buying individual bonds. When you think to invest in Bonds must consider to Invest in Bonds fund.

Bond Funds Advantages

Bond funds gives you diversification across different bond types, reduces risk compared to a single bond. They have professional management to navigate the bond market and liquidity so you can buy or sell shares quickly. Bond funds is also a cost effective way to get a diversified bond portfolio without big individual investments.

Things to Consider before you Invest in Bonds Fund

Before you invest in bonds fund, consider the fund’s objectives, fees and risk profile. Investors should assess their investment goals, time horizon and risk tolerance to choose bond funds that fits their financial goals. Understand the fund’s investment strategy and historical performance to make informed decisions.

Other Bonds

Aside from bond funds, investors can also explore other types to invest in bonds to diversify and manage risk. Foreign bonds for example gives you exposure to international markets and currencies, diversification beyond domestic investments. Exploring different bond options allows you to tailor your bond portfolio to your investment goals and risk tolerance.

Foreign Bonds

When you Invest in bonds like foreign Bonds gives you geographical diversification and exposure to different economic conditions. Foreign bonds may give you higher yields and currency appreciation but comes with additional risks like currency fluctuations and political instability. Evaluating the credit quality of foreign issuers and understanding exchange rate risks is crucial when investing in foreign bonds.

Try Different Bonds

Try zero-coupon, municipal or corporate bonds and customize your bond portfolio based on your risk tolerance and income goals. Different bond types has different risk and return potential, for different types of investors. Diversify across different bond types to reduce risk and improve performance.

Pros and Cons of Investing in Bonds

Bonds being a securities type and an investment that is sold to the public, it has its merits and demerits as is outlined below.

Having bonds in an investment portfolio has its advantages and disadvantages that must be put into consideration by the investors. Some of the benefits of bonds include, revenue derivations, capital protection and diversification encompassing risk less appeal to risk adverse investors. Though, challenges such as interest rate risk, credit risk, and inflation risk are test that can deter bonds investments but must be examined before hand.

The advantages to Invest in Bonds

It is ideal for investors in search of constant income flows since bonds offer fixed and regular income in the form of interests on the bond. They can also serve as a portfolio diversifier so that the risk of total investment can be minimised. They are less sensitive to market risks in contrast to equity so are often used to provide insurance against an unfavourable equity market.

Challenges to Invest in Bond

That been said, there are some risks that one has to face when you invest in bonds, fluctuation in interest rates can influence both price and yield of your bonds. Credit risk whereby the bond issuers can be bankrupted in making the necessary payments and risk of purchase value being eroded by inflation are some of the factors that ought to be considered. All these risks have to be tested and to avoid the impacts of these risks investors should consider diversification in their bonds.

More about Investing

Savings is a general and fundamental concept in wealth creation, and it is crucial for an individual to know the many possibilities of investment. An important part of this is including the knowledge of how to buy various instruments: for example, bonds. For more information on the basics of investing and other useful pieces of advice visit how2-invest.com.